Bitcoin faces pressure as US trade deficit hits $301 billion Liam 'Akiba' Wright · 4 seconds ago

Bitcoin faces pressure as US trade deficit hits $301 billion Liam 'Akiba' Wright · 4 seconds ago

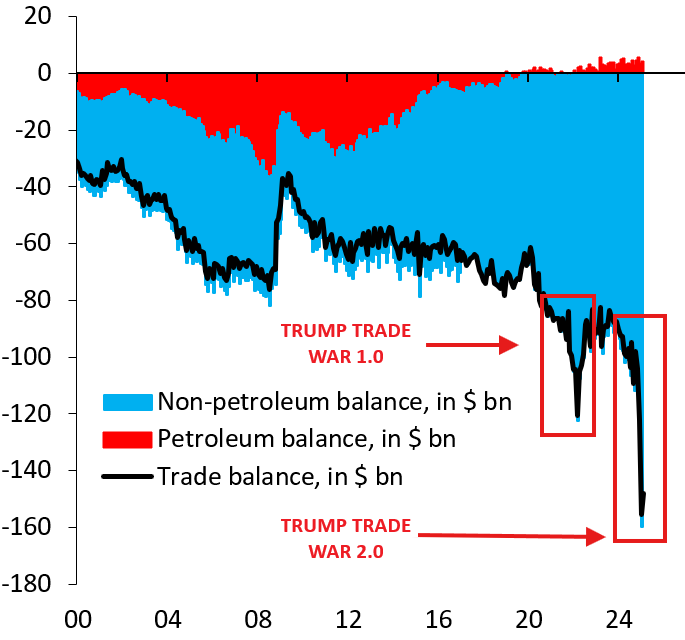

The U.S. has recorded an unprecedented two-month goods trade deficit totaling $301 billion amid corporate efforts to front-run anticipated tariffs, according to an analysis by the financial commentary outlet The Kobeissi Letter.

The trade imbalance reached historic levels in January and February, with monthly deficits of $153.3 billion and $147.9 billion, respectively—far surpassing the previous peak during the initial phase of the Trump administration’s trade conflict.

US tariff wars (Source: The Kobeissi Letter)

US tariff wars (Source: The Kobeissi Letter)The severity of these deficits reflects heightened uncertainty over tariff policies affecting approximately $240 billion in annual auto imports, nearly half of which originate from Mexico.

The resulting surge in imports—particularly industrial supplies such as oil, LNG, steel, and gold—has significantly widened the non-petroleum goods deficit, emphasizing structural vulnerabilities within the U.S. trade framework.

As highlighted by The Financial Times, concurrent with trade disruptions, U.S. financial markets have diverged from global equities.

Since President Trump’s January inauguration, U.S. stocks, represented by the MSCI USA index, have declined nearly 2% year-to-date, whereas global equities, measured by the MSCI World ex USA Index, have advanced approximately 9%.

The divergence accentuates investor concerns over sustained economic disruptions and tariff implications on corporate profitability and growth.

Amid these developments, physical gold purchases in the U.S. surged, driving inventories up over 100% year-to-date and pushing gold prices to approximately $3,100 per ounce. This increase signals widespread hedging against prolonged economic uncertainty reminiscent of historical recessionary behaviors.

With Bitcoin highly correlated with the US markets currently and decoupled from gold, the US economy could drastically effect Bitcoin performance over the next few months. Unlike gold, Bitcoin is not performing like a risk-on asset.

While many Bitcoiners see Bitcoin as the future of the global economic system, in 2025, its price is heavily reliant on US economics.