MicroStrategy buys nearly 80,000 BTC in November, outpacing US Bitcoin ETF purchases Oluwapelumi Adejumo · 34 mins ago · 2 min read

MicroStrategy buys nearly 80,000 BTC in November, outpacing US Bitcoin ETF purchases Oluwapelumi Adejumo · 34 mins ago · 2 min read

The Michael Saylor-led firm now holds more than 330,000 BTC, which valued at around $30 billion.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Michael Saylor’s MicroStrategy has made its largest Bitcoin purchase to date, acquiring 51,780 BTC for $4.6 billion at an average acquisition price of $88,627 per coin, according to a Nov. 18 filing with the US Securities and Exchange Commission (SEC).

The move comes just a week after the firm purchased 27,200 BTC for $2.03 billion. Combined, the transactions bring the company’s total Bitcoin purchases for November to nearly 80,000 BTC, valued at over $6.6 billion.

These aggressive BTC purchases have bolstered its total Bitcoin holdings to 3331,200 BTC, which it acquired for $16.5 billion at an average price of $49,875 per coin. At current prices, these assets are worth around $30 billion.

The firm stated that its latest purchase pushed its BTC yield on the year-to-date metric to 41.8%. Bitcoin yield is an essential key performance indicator the company uses to measure how its BTC investment strategy impacts its shareholders.

However, despite the scale of this acquisition, MicroStrategy’s stock price saw minimal movement. Pre-market trading data from Google Finance shows a slight increase of 0.23%.

MicroStrategy vs. Bitcoin ETFs

Meanwhile, the latest Bitcoin buy means MicroStrategy has purchased more of the top crypto than all of the US spot Bitcoin exchange-traded funds this month.

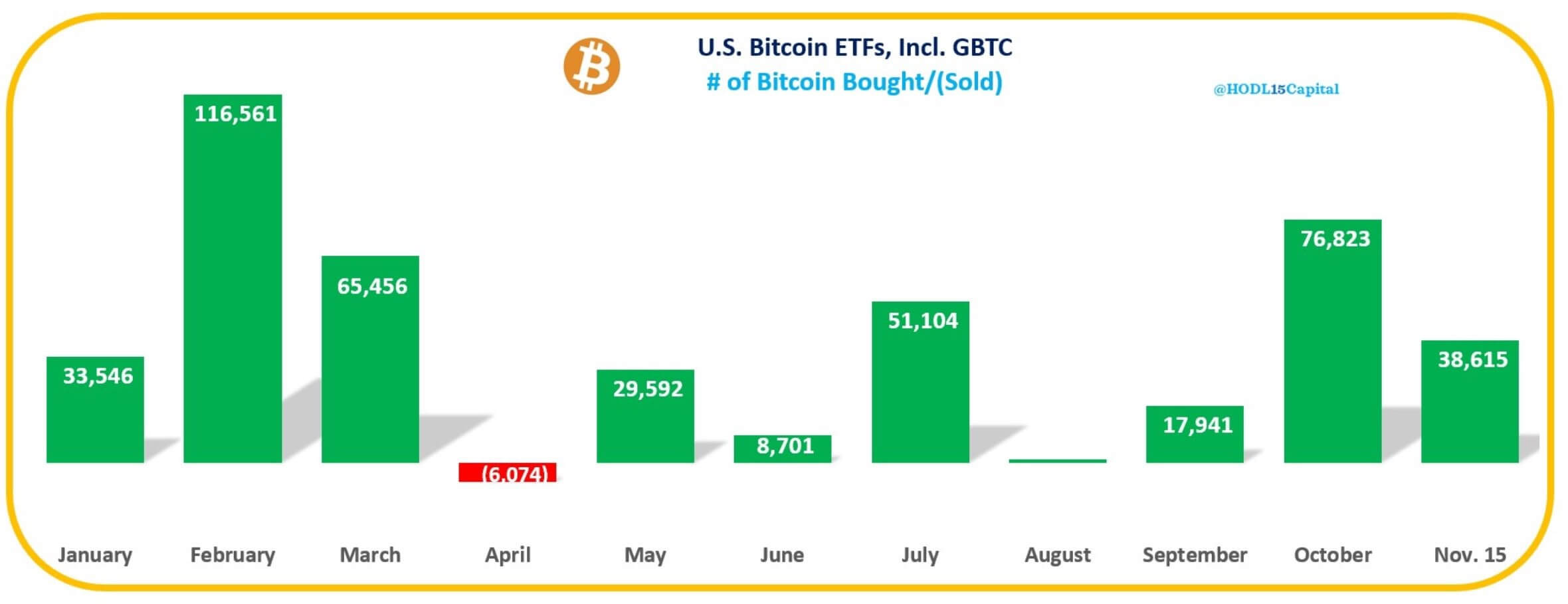

Data compiled by HODL15Capital shows that these high-flying BTC-related financial instruments have acquired 38,615 BTC as of Nov. 15. BlackRock’s IBIT led the acquisitions during this period, purchasing more than 37,000 BTC.

Bitcoin ETF BTC Purchases (Source: X/HODL15Capital)

Bitcoin ETF BTC Purchases (Source: X/HODL15Capital)Unsurprisingly, MicroStrategy’s BTC buying strategy has drawn significant market attention for altering the software firm’s financial structure and positioning it as a prominent advocate for digital asset adoption.

Market observers have pointed out that the firm’s corporate treasury reserve now surpasses all but 14 S&P 500 companies like the iPhone maker Apple and Google’s parent company, Alphabet.