Introduction

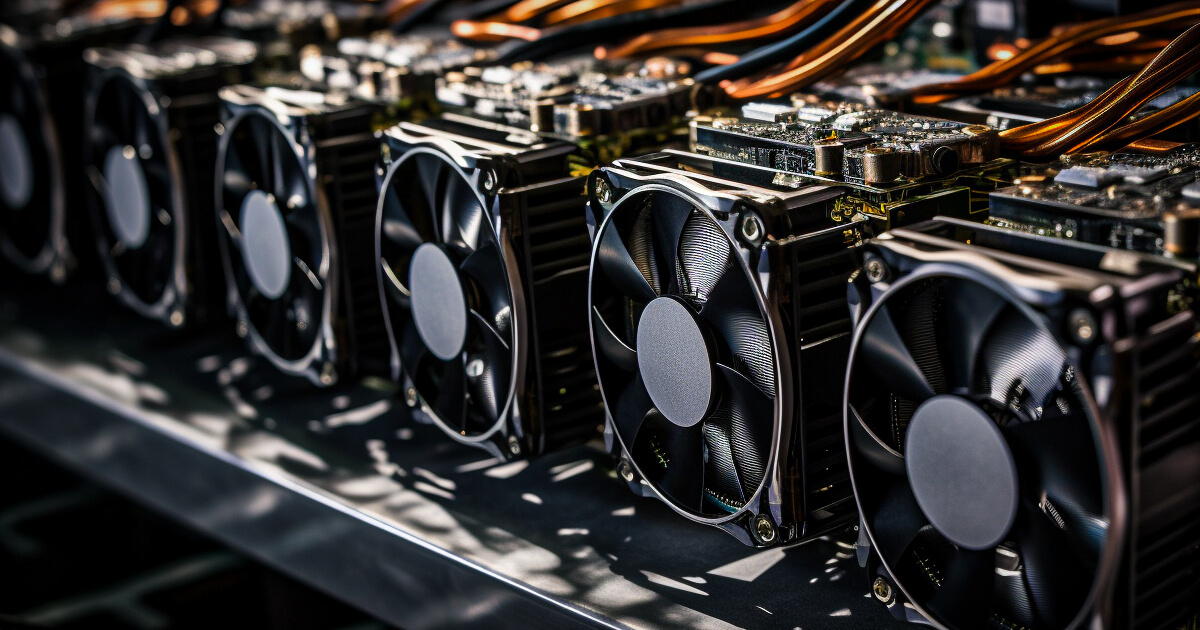

The launch of spot Bitcoin exchange-traded funds (ETFs) marked a transformative moment for the crypto industry. When the first spot Bitcoin ETFs debuted on Jan. 10, 2024, they represented more than a new investment product—they bridged the gap between the traditional financial system and the rapidly evolving world of digital assets.

Years of regulatory challenges, market anticipation, and strategic lobbying efforts culminated in their approval, with the U.S. Securities and Exchange Commission (SEC) finally greenlighting these funds after rejecting numerous prior applications.

Historically, the road to spot Bitcoin ETF approval was fraught with regulatory hurdles. The SEC’s initial reluctance stemmed from concerns about market manipulation, liquidity, and the lack of robust surveillance-sharing agreements.

However, the agency’s stance shifted in late 2023 following the introduction of enhanced market oversight mechanisms by major exchanges like Nasdaq and CME. Additionally, increasing pressure from influential financial institutions and growing demand from investors were pivotal in changing the regulatory landscape.

The approval and subsequent success of spot Bitcoin ETFs cemented Bicoin’s maturation as an asset class. By offering a regulated, easily accessible vehicle for investment, these ETFs attracted a new cohort of investors who had previously been deterred by the technical and security challenges associated with direct Bitcoin ownership. The presence of traditional financial heavyweights lent further credibility to Bitcoin, solidifying its place in institutional portfolios alongside stocks, bonds, and commodities.

In this report, CryptoSlate will dive deep into the first year of spot Bitcoin ETFs, examining key trends, capital flows, performance metrics, and their impact on the crypto market. We will evaluate how these ETF products affected the market and explore their implications for the future of Bitcoin. With over 1.1 million BTC under management by year-end, the first year of spot Bitcoin ETFs showed their potential in bridging traditional and digital finance.

To continue reading the market report, sign in or join CryptoSlate Alpha.

Unlock this Market Report with CryptoSlate Alpha

This Market Report is only available for CryptoSlate Alpha members. CryptoSlate Alpha is a web3 membership built to empower you with cutting-edge insights and knowledge, built in partnership with Access Protocol.

Included in your membership

Exclusive Research & Analysis

Crypto, Macro & DeFi Insights

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

⚡️ CryptoSlate Alpha requires a one-time purchase of our membership NFT using SOL, the native token of Solana. Connecting your Solana wallet is required to complete the purchase. CryptoSlate is proud to be a launch partner and grant recipient of Access Protocol. For more information, see our terms page.