Bitcoin futures volume spikes almost 300%, but open interest wanes amidst market volatility Andjela Radmilac · 53 seconds ago · 4 min read

Bitcoin futures volume spikes almost 300%, but open interest wanes amidst market volatility Andjela Radmilac · 53 seconds ago · 4 min read

Bitcoin futures volume ballooned in response to geopolitical tensions, revealing a speculative market with shrinking commitments.

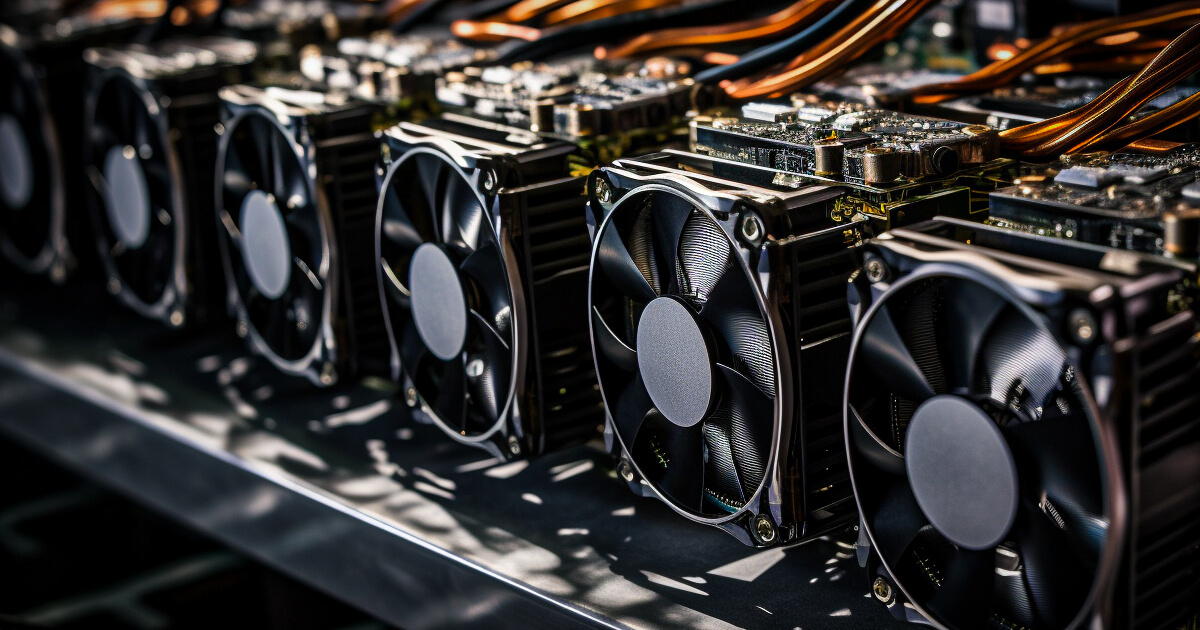

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

In the fast-paced world of Bitcoin futures trading, recent days have seen a dramatic spike in trading volumes, with activity soaring by a jaw-dropping 292% in just 48 hours. But while volumes skyrocketed, a surprising trend emerged: open interest actually fell, revealing a fascinating divergence in the market. What could possibly cause such a flurry of trading activity without a corresponding rise in commitment to positions? Unravel this mystery and discover how macroeconomic tensions triggered a whirlwind of speculation and forced liquidations. Curious? The full story awaits.